words Elaine Knutt and Marcus Fairs

The defining event at this year’s Milan Design Week was not a product launch or a party, but a takeover announcement. Cappellini – the most aristocratic of Italy’s small, family-run furniture houses – has been rescued from bankruptcy by a conglomerate and its figurehead, the legendary Giulio Cappellini, forced to surrender day-to-day management to the suits.

Cappellini is now owned by Poltrona Frau, a leather upholstery specialist with a portfolio that includes the Lowry Centre auditorium and interiors for Porsche and which in the past few years has also snapped up Thonet and Gufram.

Poltrona Frau has an enviable reputation for quality and detailing, but it’s still a bit like Harvey Nichols being marched up the aisle by John Lewis, or Ian Schrager being taken over by Marriott. After all, in New York’s Museum of Modern Art, 15 out of the 35 pieces in the permanent furniture collection are produced by Cappellini.

The news sent shockwaves around this year’s furniture fair. “Cappellini has given us so much to enjoy and helped us all to believe that design was a profession to celebrate,” said Marcel Wanders who, like many leading designers, was discovered and nurtured by the firm. “The future of a giant is [now] in danger. I hope so much Cappellini will survive.”

“He knew how to be sexy and ahead of the game,” says another admirer, before adding sadly “But perhaps a bit too far ahead.”

Rumours of trouble at Cappellini had been circulating for months. The company is understood to have been heavily in debt, with quality control and trading problems that resulted in ever-lengthening delivery times. At this year’s fair, lurid – and unproven – gossip about tax evasion, non-payment of royalties and copyright infringement was doing the rounds.

At the Cappellini opening party, a sombre Giulio Cappellini stood to one side as his new bosses announced their plans for the business that he inherited from his father. He will continue to work for the company, but he has been demoted to creative consultant. “He will define the product strategy,” says Poltrona Frau president Franco Moschini, speaking through an interpreter. “He will be the talent scout for younger designers.”

Moschini announced the creation of Cap Design, a new business vehicle for the Cappellini range. “Cap Design will remain a company for the design-oriented consumer,” he said. “There will be no big changes, but we will find the best way to improve the performance through synergies with the Poltrona Frau companies. There are economies of scale; we can buy raw materials in a better way.”

A spokesperson for Cappellini admitted that Giulio felt a sense of “personal loss”, but added: “It also brings more freedom to pursue the creative side of the business. Cappellini will continue to invest in research and design that are the peculiar aspects in the history of the company. The new management is taking care of the commercial and financial aspects of the organisation.”

This is a tough time for Italian furniture makers, and the other Italian micro-brands must be wondering how long they can retain their independence. For all its worldwide influence, the fact is that the €18.9 billion (£12.7bn) sector is essentially an overgrown cottage industry. Most of the familiar Milanese brands are small family-owned firms – Cappellini was founded in 1946 by Giulio’s father and has 100 employees and a turnover of €30m (£20.25m). Production is in-house, or outsourced to small, local workshops. But both options miss out on economies of scale, and face competition from cheaper Far Eastern imports.

In the past four years, the sector has seen a slump in sales paralleling the economic woes of the key US and German markets, along with rising raw material prices. In 2003, the strength of the dollar led to a 16.3% decline in US sales. Cappellini, which had up to 17% of its sales in the USA, suffered particularly badly. But it certainly isn’t the only company struggling.

In other words, Italian design is ripe for renovation, and it’s not surprising that investors from other industries have spotted its potential. Poltrona Frau was able to finance the Cappellini acquisition thanks to funds released by the sale last October of 30% of its shares to Charme, an investment fund managed by Italian industrialist and Ferrari chairman Luca Cordero di Montezemolo. “Our objective is to create a new industrial group to respond to an increasingly globalised with new resources and ideas,” di Montezemolo told icon. “One of our main objectives is to support the Italian medium-sized companies that form the industrial force of our country. [The Poltrona Frau group] appealed to us as a perfect target for investment and as a basis to address an overall promotion of the Italian concept of beauty on a global scale.”

Montezemolo is using Charme to invest in a string of luxury labels: Tod’s shoes, Ballantyne’s cashmere, and now Cappellini furniture. It’s all reminiscent of the portfolio-building practised by luxury groups such as LVMH and Gucci, which bring a variety of products under the roof of one design house to share costs.

Wherever new investment comes from, it could bring some overdue corporate discipline. “Design doesn’t have access to distribution. You can’t go into M&S and buy Kartell,” says Charles Keen, founder and part-owner of UK furniture company Keen. “A designer shop might have one Philippe Starck plastic chair in stock.”

But the Italian furniture barons are facing other pressures. Brands like Cappellini have been far too slow to respond to growing public interest in design, continuing to produce big-ticket, iconic pieces of furniture that look more at home in art galleries than people’s homes. Everyone from High Street stores to fashion brands are muscling in on the booming home furnishing sector; yet the designer sector persists with intimidating showrooms, hopelessly long delivery times and indistinguishable brands.

“The Italian gurus have been very introverted when it comes to product,” says Pascal Dowers, MD of Greenwich Village, the UK agent for Edra furniture. “They need greater expertise at tapping into markets. As furniture and design have become more fashionable, you need experts from the fashion industry to market it.”

“They’re already preaching to the converted,” says Tyler Brûlé, chief executive of creative agency Winkreative. “Not everybody lives in a concrete bunker overlooking Lake Lugano. [Design brands] are intimidating as they all employ a strict, sober approach to communication. The press advertisements all look the

same. If you look at fashion or automotive advertising, the brand values leap out at you.”

“Communication to the customer has to change,” agrees Roberto Falchi, the new chief executive of furniture company B&B Italia (see interview, below). “I think it’s very difficult for the consumer to understand the difference between the brands. The language is a bit static.”

B&B Italia is already going through a major shake-up. In February 2003 it sold 55% of its shares to Opera, an investment fund backed by jewellery group Bulgari. Opera’s first move was to appoint Falchi, who brings experience from the fashion retailing including stints at Prada and Christian Dior, and who now intends to import marketing and branding techniques common in fashion but unheard of in furniture. He has also signed up Brûlé’s Winkreative agency to invigorate B&B’s marketing.

Falchi has big plans: he aims to grow sales 27% by 2006 and open 13 new stores to add to its current five, it wants a more visible presence on the high street and in people’s lives. And in a move that sounds a bit like the sunglasses-and-perfume strategy of the fashion labels, B&B Italia is launching a range of lifestyle “accessories”. Candlesticks and crockery will be the entry point on a retailing ladder where consumers work their way up to armchairs, storage and sofas. In the stores, furniture will not be displayed as objets d’art, but rather in styled “living settings”.

Under its new ownership, Cappellini seems to be heading in the same direction. “Today the real mission of design is to be in people’s houses – and not only in the museums of contemporary art,” a spokesperson told icon. “Presently we are working on new projects keeping in mind the new attitude of the end consumer in the furnishing field. We try to create pieces that are lighter and easily movable through the different rooms of the house.”

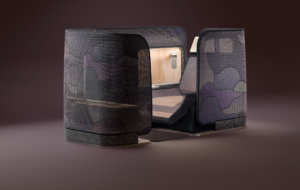

The furniture world is still waiting to pass judgement on the Poltrona Frau deal, unsure of the impact on Cappellini’s trademark innovation. But Sheridan Coakley, managing director of London retailer SCP, was impressed by the first offspring from the odd marriage. “It was the first time in three years that I bought any of their products,” he says, referring to the Oblong sofa by Jasper Morrison and the “Cloud” bookcase by the Bouroullec brothers. “To me, that says something. They had limited time and resources and had gone through a difficult time, but it was quite refreshing.”

Brûlé is unconvinced that furniture will follow the lead of northern Italy’s other great industries – fashion and cars – and bow to the forces of globalisation. “You will see consolidation but this is by no means the end of the small, family-run company,” he says. “I don’t think these companies can be corporatised; it’s just that a lot of them don’t appreciate what they’re sitting on.”

Roberto Falchi joined B&B Italia as chief executive last year after many years in fashion retailing. He told icon where design retailing is going wrong.

“In the past [the Italian furniture industry] has been too focused on product and not enough on lifestyle and ambience. It has to change. Communication to the customer has to change. I think it’s very difficult for the consumer to understand the differences between the brands. The language is a bit static. What shocked me was to see how primitive the distribution and communication is in furniture. There is a strong interest in design, but people don’t know how to consume these brands. I think this is a big opportunity.

We have a new marketing, communication and distribution strategy. It’s a major change; we are one of the first design companies to do this.

During the time of minimalism, when the furniture was presented as an artwork, it was a bit intimidating for the consumer. When you present objects in an ambience [a room set] it is much easier for the consumer to see if there are things they want.

In the past, the company’s mission has been to launch products every season but I don’t think there are consumers waiting for new sofas to come out. We’ll introduce complementary accessories to increase visits to the store – B&B branded objects. We’ll change the small objects regularly, not the large ones.

And there is an explosion of requests for these smaller products. This is a sign that people are eager to buy design. Young fashion consumers will be our consumers in five or ten years’ time.